With our Real-Time Treasury approach to real-time data connectivity

Data analytics has always been useful, but access to real-time data is becoming more relevant to many businesses.

The data world is shifting: instead of analyzing data and drawing conclusions from a series of past events, systems are now working in real time to provide insights into what’s happening in that business today. Data analytics has always been useful, but access to real-time data is becoming more relevant to many businesses. By using the right technology, companies can benefit from access to real-time data at any time, increasing efficiency and saving time.

Real-time data connection based on Open Banking and API

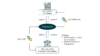

Our technical solution for implementing a real-time liquidity overview is based on Open Banking and API connection. SAP requests the bank data from corresponding middleware, which in turn requests the data from the bank. Open Banking structures under the PSD2 directive require The Bank to provide the account data, enabling real-time access to account activity. Integrated into a real-time treasury dashboard, the real-time information can be transferred via CDS views from the SAP system to the SAP Analytics Cloud, where it can be visualized in a user-friendly and clear manner. The following figure outlines the schematic process.

Successful implementation of the real-time connection depends on the various project parties. The industry partners focus on adapting the bank account management and ensuring the connection to the middleware. The middleware provider makes the relevant API available. On the bank level, the provision of the relevant APIs, multi-currency accounts and the realization of the real-time interest calculation takes place.

Competitive advantages through the use of real-time connectivity

Increased connectivity and automation can give companies important competitive advantages in many areas, but especially in strategic decision making:

Increased liquidity:

Companies can have free cash available sooner, plan outgoing payments more accurately, and reduce their liquidity management

Cost reduction:

Real-time treasury lowers costs through a higher degree of automation and the reduction of manual work steps

Reporting quality:

Instant payments and invoices enable faster cash flow forecasting and better visibility

Predictive analytics:

Predictive analytics enables making better-informed statements about future developments based on current data

Exposure minimization:

Real-time visibility into current exposure enables significant reduction in response times

Increased revenue:

Released funds enable more investments and lead to higher interest and investment income

Minimization of volatility:

FX management can dynamically identify risks to minimize exposure and intraday volatility.

In light of these developments, treasurers must revise and redefine the way they work to keep pace with the “real-time” world.

Transforming outdated and inefficient treasury operations into real-time management holds tremendous potential and offers treasurers the opportunity to step back from repetitive tasks and perform their risk and liquidity operations in a more strategic manner. In addition, better investment returns and improved credit and foreign exchange risk management can be achieved, while increasing the transparency and efficiency of liquidity visibility and planning.